Florida Businesses Sold in Florida 2013 Year End Summary

I am a Florida Business broker based out of Ponte Vedra Beach (near Jacksonville) working with business owners selling their Florida businesses, and individuals and business owners looking for acquisitions. Prospective business buyers I work with are located in Florida, US., and Business buyers in Europe and throughout the world.

As a member of Business Brokers of Florida, which is the largest state Association of Business Brokers in the United States we have access to significant data regarding businesses being bought and sold . Thousands of businesses for sale are represented by over 1000 Business Professionals involved with business acquisition and sales that are members of this Association. Business brokers in this association list their respective businesses for sale and prospective business buyers on a centralized listing site and buyers and sellers of businesses are brought together.

Several thousand businesses for sale are listed, modified, and advertised thru this Association. They can also be viewed on my website here at Florida Businesses For Sale. To further my knowledge, I believe understanding the marketplace in which Florida business may be sold is furthered by a review of the data surrounding businesses being bought and sold in Florida. The below are a few statistics, totals, and items of note surrounding the business acquisition and sales market in the State of Florida. Other businesses are bought and sold without the assistance of members Business Brokers of Florida, and that info is not included in this analysis.

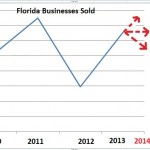

Businesses Sold in Florida through Business Brokers of Florida in 2013 – 909

- Businesses Sold in 2012- 950

- Businesses Sold in 2011- 859

- Businesses Sold in 2010- 931

Averages of all businesses sold in 2013:

- Average Sales – $572,000 Average Price Sold For- $286,000 Average Adjusted Net Cash Flow- $114,000

- Days on Market 225 (note all DOM (days on market) numbers DO NOT include those taken off the for sale market)

- Florida Business Sold in 2013 for $1M or more-30

- Florida Business Sold in Florida that included Real Estate- 47 (only about 5%)

- Category with most Businesses Sold- Restaurants- 199 sold in 2013 currently there are 3209 Florida Businesses For Sale and of those for sale 717 are Restaurants. (22% of all businesses for sale are Restaurants)

- Florida is a highly Service based economy, the other categories with highest number of Sold Businesses in 2013 in Florida are in the service sector and include Hair Salon, Dry Cleaners, Lawn Service, Pools Service Businesses.

- Florida Businesses for sale requiring Down Payment of $50,000 or less – 480

- Florida Businesses For Sale with Net Income of $100,000 or more- 1264

- Florida Businesses For Sale with Net Income of $300,000 or more- 239

I am a Business Broker based in the Jacksonville Florida area ( main office is in Fort Myers Florida area). Below is some 2013 information about Business Sold in the Jacksonville Florida area and Businesses For Sale in the Jacksonville Florida area.

- Jacksonville Florida area Businesses Sold in 2013- 53

- Averages for the 53 Jacksonville Florida Businesses Sold in 2013:

- SALES- $558,000 Average Sold Price- $226,000 Average Adjusted Net Income- $142,000 Average Days on Market*- 218 Days

- Total Businesses For Sale in Jacksonville Florida area as of Jan.1 2014. -227

- Jacksonville Florida area Businesses For Sale with Net Income of $100k or more- 99

- Jacksonville Florida area Businesses For Sale that require Down Payment of $50k or less- 33

- Jacksonville Florida area Businesses For Sale that have Net Income of $250k or more- 26

- Averages for the 53 Jacksonville Florida Businesses Sold in 2013:

I have been following Florida Business Sales over the last 4-5 years and the above numbers have been somewhat consistent. I believe there remains a pent up demand in both the Buyers and Sellers side. The buyers still are slowed down by financing options and some potential Sellers are still delaying putting their business up for Sale due to uncertainty. As a former long term business owner, I realize the thought and contemplation that goes into the decision to sell ones business. The only real certainty is that another year will come and go, time marches on, at this time next year will your activities be included in the 2014 year end summary?

*All above info compiled from data available via the bbfmls website. And addresses information about businesses being bought and sold and reported thru this Professional organization of Business Brokers of Florida.

For more info or questions regarding the Florida Business Acquisition Market or Florida Businesses for sale please contact

Scott M Messinger

Scott@Sellabusinessflorida.com

239.770.2421